When searching for the best budgeting tools, real users’ experiences make all the difference. In this ranking, we considered customer satisfaction and review scores as major criteria. If you want to find a reliable budget app that won’t cost a cent, you’re in the right place.

Is there a free budget tool?

Absolutely—many of the best free budgeting apps offer robust features at zero cost. Free plans usually cover essentials like tracking spending, setting goals, and even importing transactions. Below, you’ll find a ranking of the best free budget tools based on user reviews, satisfaction, and real-world feedback.

Ranking: Best Free Budgeting Apps 2025

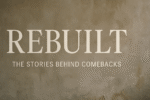

1. GnuCash (4.8⭐)

User Rating: 4.8/5

Platform: Windows, Mac, Linux, Android

Price: Free (Open Source)

GnuCash stands out for users who want a professional, open-source solution that doesn’t hide features behind paywalls. Many describe it as “reliable,” with one user stating, “It’s the only free app that handles double-entry accounting without fuss.”

It supports both personal and small business finance, allowing tracking of multiple accounts, investments, and even invoicing. Some say the interface is a bit old-school, but users consistently praise its depth and stability.

“I’ve used GnuCash for years to track both family expenses and freelance income. It’s more powerful than apps that charge monthly fees.”

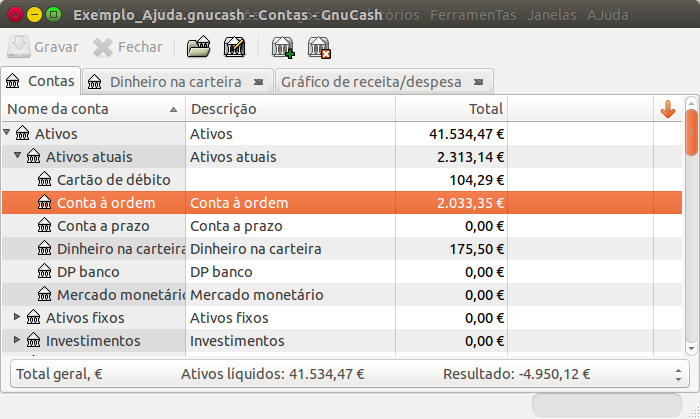

2. HomeBank (4.8⭐)

User Rating: 4.8/5

Platform: Windows, Mac, Linux

Price: Free (Open Source)

HomeBank delivers an intuitive, visual approach to money management. Budgeters love its easy graphs and insightful reports. “The pie charts help me spot trends quickly,” says one user, while another mentions, “It’s simple enough for beginners but flexible for serious planners.”

Automatic transaction import, customizable categories, and strong reporting are its core strengths. For those seeking a monthly budget spreadsheet experience, HomeBank bridges the gap between classic spreadsheets and modern apps.

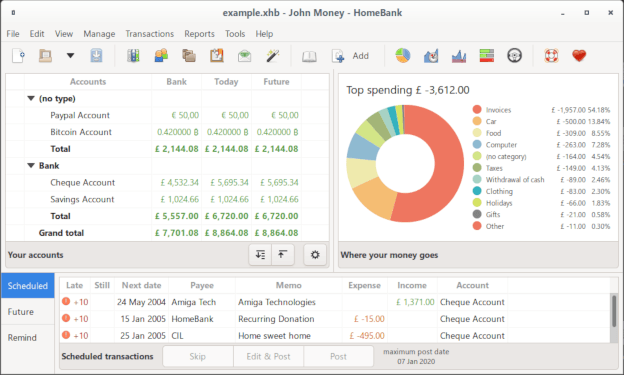

3. KMyMoney (4.8⭐)

User Rating: 4.8/5

Platform: Windows, Mac, Linux

Price: Free (Open Source)

With a clean interface and robust features, KMyMoney is often praised as “the closest thing to Quicken, but free.” It’s great for anyone who wants to track bank accounts, investments, and budgets in detail.

“I switched from a paid app to KMyMoney and never looked back. It does everything I need—budgeting, forecasting, even handling my mortgage,” shares a long-time user.

This app is favored by those who want deep control and detailed reporting, without ads or data sharing.

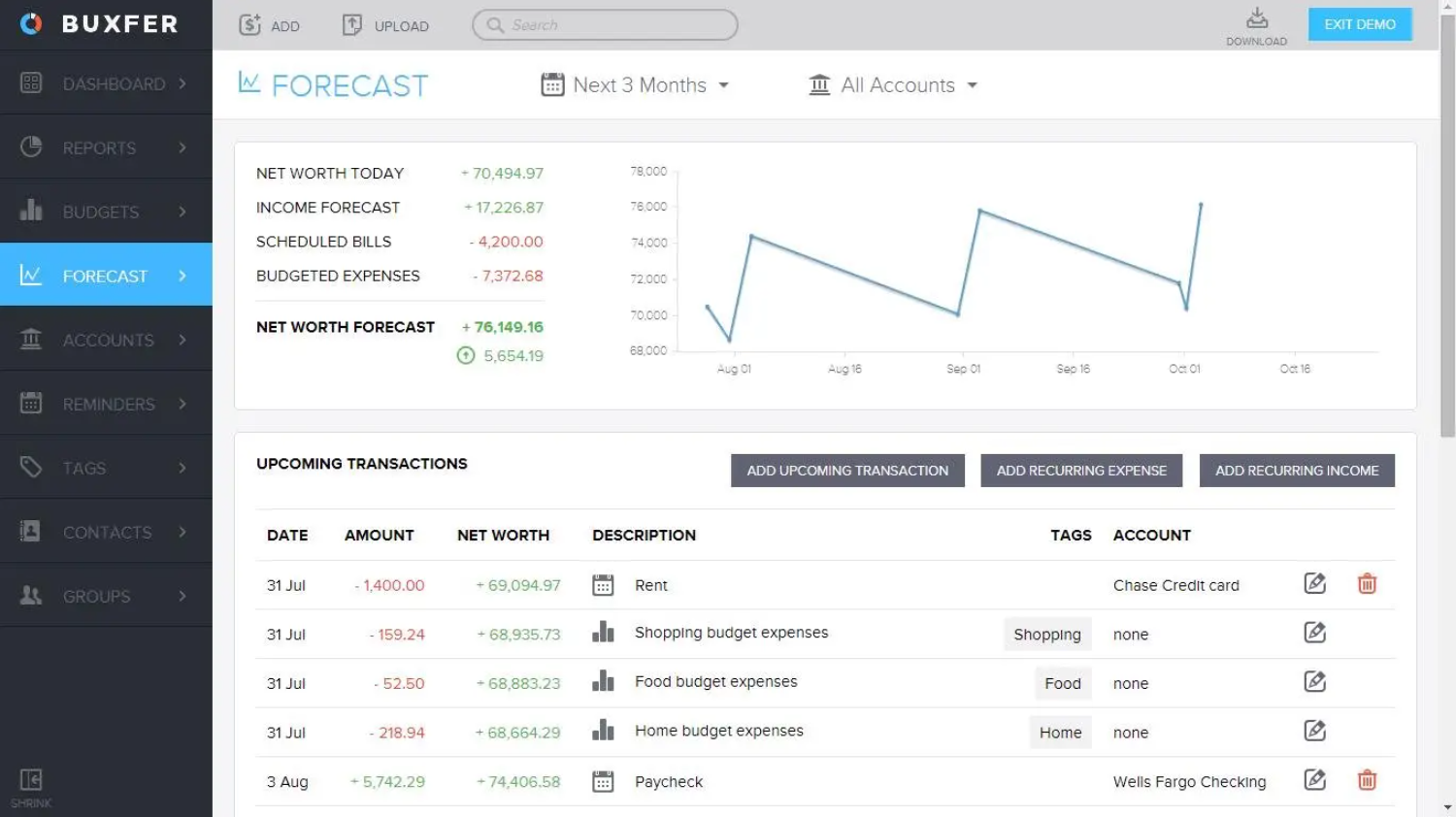

4. Buxfer (4.0⭐)

User Rating: 4.0/5

Platform: Web, iOS, Android

Price: Free (Limited Plan)

Buxfer is popular for its cross-device sync and slick interface. Many appreciate its cloud access and simple setup.

One user comment: “Buxfer’s free plan lets me split expenses and track my bank balance—perfect for roommates.”

It offers transaction import, budgeting, forecasting, and bill reminders. Power users may want paid features, but the free plan suits everyday budgeting and shared expenses.

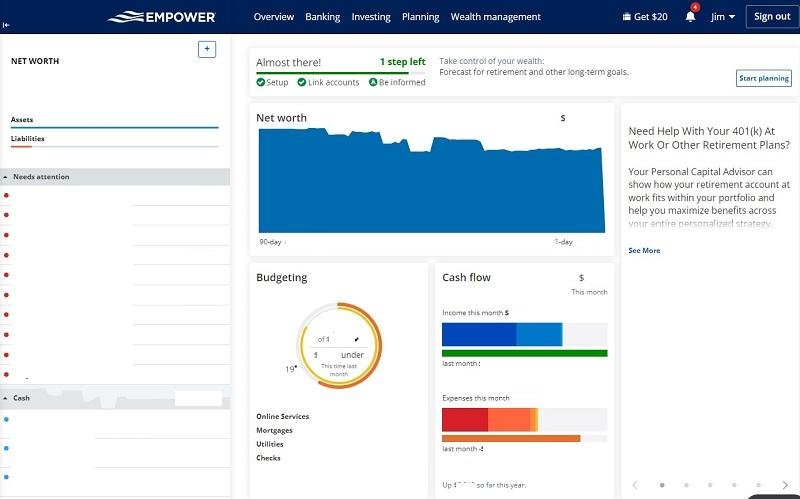

5. Empower Personal Dashboard (3.9⭐)

User Rating: 3.9/5

Platform: Web, iOS, Android

Price: Free (Some features require sign-up for additional services)

Previously known as Personal Capital, Empower Personal Dashboard provides a modern dashboard to manage net worth, investments, and budgets.

“Empower’s graphs are top-notch for tracking investments, and the budgeting tools cover the basics,” says one reviewer.

Some note that signing up involves investment management upsells, but the free tools are comprehensive enough for most users looking to track spending and plan ahead.

Real User Experiences

We checked actual feedback from users on forums and reviews. Most value ease of use, transparency, and data privacy. Open-source apps like GnuCash, HomeBank, and KMyMoney get extra points for having no ads or hidden costs. Users looking for sleek apps with mobile sync often gravitate towards Buxfer and Empower, even if free features are somewhat limited.

What is a budgeting tool?

A budgeting tool is software or an app that helps you manage your income and expenses. These tools let you enter your salary, other sources of money, and then compare this to your regular and unexpected costs, such as bills, rent, groceries, insurance, and entertainment. By keeping everything in one place, budgeting tools make it easier to spot where your money goes, helping you save more and spend wisely.

FAQ: Frequently Asked Questions

What is the best free budgeting app?

The best free budgeting app depends on your needs. If you want powerful features without paying, GnuCash, HomeBank, and KMyMoney all offer top-rated, free plans. For modern cloud access, try Buxfer or Empower.

How do free budget apps make money?

Most free apps offer paid upgrades or extra features for a subscription. Some also provide investment management services or ads in the app.

Can I trust free budget tools with my data?

Open-source apps (GnuCash, HomeBank, KMyMoney) do not share your data, as everything is stored locally. For cloud-based apps, check privacy settings and terms.

How can I start using a budget planner?

Download or sign up for your chosen app, add your accounts and expenses, and let the app categorize your spending. Use reports to spot trends and set new goals.

What’s the difference between a budget spreadsheet and a budget app?

A budget spreadsheet is manual—you enter everything yourself. A budget app often automates imports, categorizes transactions, and shows reports instantly.

Deep Dive: Why Ratings and User Satisfaction Matter

Choosing a budget planner or app is about more than features—it’s about trust, consistency, and real value. Ratings reflect real experiences:

- High scores mean less frustration and more reliability.

- User stories spotlight strengths (ease of use, powerful reports, privacy).

- The best apps stay updated and offer real support.

If you’re just starting, explore the open-source options—they’re highly rated for a reason. For those needing multi-device sync, try cloud-based apps but always review privacy policies.

See More About Personal Finance

Want more practical tips and resources for managing money?

Visit Personal Finance on Wealth Docking for guides, strategies, and up-to-date insights.

Official Websites of Featured Apps

Ready to Take Control of Your Budget?

Pick a free tool from the list above and get started today.

The sooner you track your money, the sooner you’ll see results. Whether you want the power of an open-source program or the convenience of a cloud app, there’s a perfect solution for you. Start budgeting smarter, not harder.